Why Zambia’s Decision to Accept Chinese Yuan for Mining Taxes Is a Game Changer

By Dr Lubinda Haabazoka

Zambia has quietly made economic history. By allowing mining companies to pay statutory taxes and royalties in Chinese currency, the Yuan (Renminbi), the country has become the first in Africa to take such a step. While the decision may appear technical, its implications are far-reaching for fiscal management, foreign exchange stability, and Zambia’s positioning in a changing global trade system. This is not a symbolic or political gesture. It is a pragmatic policy milestone grounded in economic logic, trade realities, and the need to reduce structural pressure on the United States Dollar.

A Policy Grounded in Economic Logic

At the heart of this decision is the principle of currency matching. Economies are more resilient when the currencies in which governments collect revenues align with the currencies used for trade, investment, and debt-related transactions.

Zambia maintains deep trade and investment links with China, particularly in mining, infrastructure development, machinery, industrial equipment, and project financing. Allowing mining taxes to be settled in Yuan reduces unnecessary currency conversions, lowers transaction costs, and improves efficiency in public finance management.

Instead of collecting revenues in Kwacha, converting them into US Dollars, and then into Yuan to meet certain obligations, Zambia can now streamline these flows directly.

What Is the Chinese Yuan?

The Chinese Yuan, officially called the Renminbi (RMB), is the legal tender of the People’s Republic of China. Over the past two decades, it has evolved from a largely domestic currency into a globally recognised medium of exchange. China is the world’s second-largest economy and the largest trading nation. As a result, the Yuan is increasingly used in cross-border trade, infrastructure financing, and bilateral settlements across Asia, Africa, and other emerging markets.

Global Recognition Through the IMF SDR Basket

The Yuan’s international credibility was firmly cemented when it was included in the International Monetary Fund’s Special Drawing Rights (SDR) basket. The SDR basket is composed of currencies considered systemically important to global trade and finance.

For Zambia, collecting and holding a currency that forms part of the SDR basket strengthens the quality of its foreign exchange reserves and enhances confidence in its external position.

Lower Transaction Costs in Debt Service and Trade

One of the most immediate benefits of this policy is the reduction in transaction costs. Each currency conversion involves fees and exposes the economy to exchange-rate volatility. By collecting Yuan directly, Zambia can more efficiently meet obligations linked to Chinese financing and settle payments for imports sourced from China, such as mining equipment, machinery, pharmaceuticals, and infrastructure inputs. This reduces dependence on sourcing scarce US Dollars in international markets.

Supporting Trade With Zambia’s Largest Trading Partner

China is among Zambia’s largest trading and investment partners, particularly in the mining and infrastructure sectors. In several segments of this relationship, Zambia records a favourable current account position, driven by mineral exports and capital inflows.

Settling taxes and trade-related transactions in Yuan allows these flows to circulate more efficiently, reducing unnecessary dollar demand and easing pressure on the foreign exchange market.

Diversifying Foreign Exchange Reserves

Modern central banking places strong emphasis on reserve diversification. Overreliance on a single currency exposes economies to concentration and liquidity risks.

By holding Yuan as part of its foreign exchange reserves, Zambia:

Reduces excessive dependence on the US Dollar

Enhances resilience to global dollar shortages

Aligns reserves with actual trade patterns

Strengthens flexibility in balance-of-payments management

This approach is increasingly common among emerging and frontier economies navigating a more multipolar global financial system.

Extending the Model to Regional Trade

The policy also opens strategic possibilities at the regional level. Zambia could explore bilateral currency settlement arrangements with key trading partners such as the Democratic Republic of Congo (DRC) and South Africa.

The DRC is Zambia’s largest non-overseas trading partner, while South Africa remains a major source of imports. Partial settlement of trade in Yuan or local currencies, particularly for minerals and intermediate goods, would significantly reduce pressure on the US Dollar and deepen regional financial integration.

A Forward-Looking Leadership Decision

This move reflects pragmatic and forward-thinking economic leadership. It acknowledges that global finance is evolving toward multipolar currency usage and that African economies must adapt to protect their macroeconomic stability.

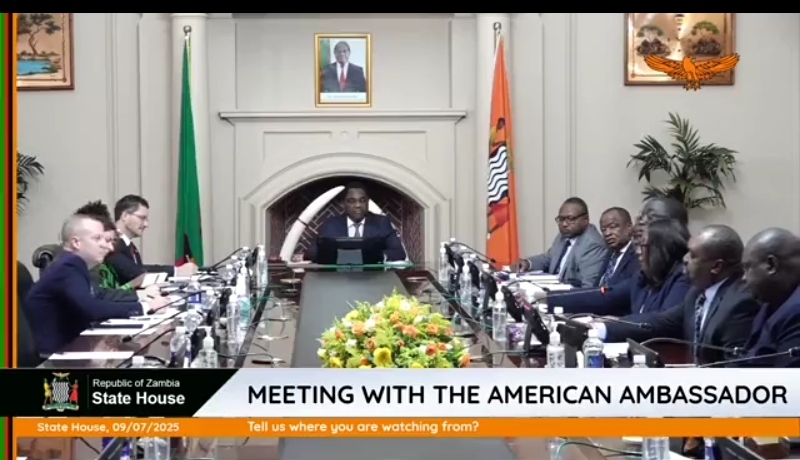

The decision, taken by President Hakainde Hichilema and his economic team from the Ministry of Finance, Bank of Zambia and the Zambia Revenue Authority positions Zambia at the forefront of Africa’s evolving trade and financial architecture, signalling confidence, flexibility, and strategic economic diplomacy.